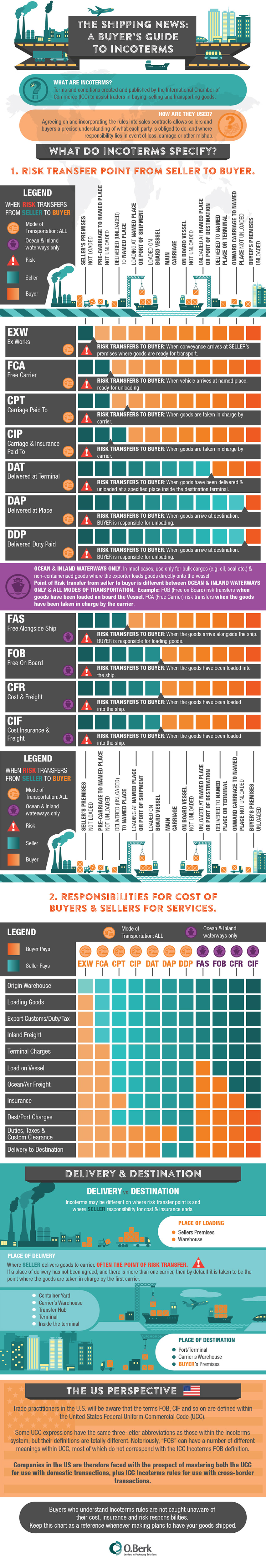

The Incoterms 2010 rules are standard sets of trading terms and conditions designed to assist traders when goods are sold and transported.

Each Incoterms rule specifies:

- The obligations of each party (e.g. who is responsible for services such as transport; import and export clearance etc)

- The point in the journey where risk transfers from the seller to the buyer

So by agreeing on an Incoterms rule and incorporating it into the sales contract, the buyer and seller can achieve a precise understanding of what each party is obliged to do, and where responsibility lies in event of loss, damage or other mishap.

The Incoterms rules are created and published by the International Chamber of Commerce (ICC) and are revised from time to time. The most recent revision is Incoterms 2010 which came into force on 1st January 2011.

There are eleven rules are divided into two main groups

- Rules for any transport mode:

- EXW - Ex Works

- FCA - Free Carrier

- CPT - Carriage Paid To

- CIP - Carriage & Insurance Paid to

- DAT - Delivered At Terminal

- DAP - Delivered At Place

- DDP - Delivered Duty Paid

- Rules for sea & inland waterway only:

- FAS - Free Alongside Ship

- FOB - Free On Board

- CFR - Cost and Freight

- CIF - Cost Insurance and Freight

In general the “transport by sea or inland waterway only” rules should only be used for bulk cargos (e.g. oil, coal etc) and non-containerised goods, where the exporter can load the goods directly onto the vessel. Where the goods are containerised, the “any transport mode” rules are more appropriate.

A critical difference between the rules in these two groups is the point at which risk transfers from seller to buyer. For example, the “Free on Board” (FOB) rule specifies that risk transfers when the goods have been loaded on board the vessel. However the “Free Carrier” (FCA) rule specifies that risk transfers when the goods have been taken in charge by the carrier.

Another useful way of classifying the rules is by considering:

- Who is responsible for the main carriage – the buyer or the seller?

- If the seller is responsible for the main carriage, where does the risk pass from the seller to the buyer – before the main carriage, or after it?

This gives us these four groups:

- Buyer responsible for all carriage – EXW

- Buyer arranges main carriage – FAS; FOB; FCA

- Seller arranges main carriage, risk passes after main carriage – DAT; DAP; DDP

- Seller arranges main carriage, but risk passes before main carriage – CFR; CIF; CPT; CIP

This last group of rules often surprises newcomers, because although the seller pays for transport to the named place, the risk transfers at an earlier point in the journey – see delivery.

Delivery

Under the Incoterms rules, “delivery” is linked to the transfer of risk and responsibility for the consignment from the seller to the buyer.

Particular care must be taken with the “C” rules:

- “CPT Carriage Paid to”,

- “CIP Carriage and Insurance Paid to”,

- “CFR Cost and Freight“,

- “CIF Cost Insurance and Freight“.

Consider this rule “CIP Hong Kong Terminal 3”

This rule obliges the seller to contract with a carrier to transport the goods to the specified place, Hong Kong Terminal 3. This is the named place of destination.

However there is another critical point – the point where the seller hands the goods over to the carrier. This is the place of delivery, where risk passes from seller to buyer.

In this example, there are a number of possible places of delivery – e.g. it could be the container yard at the place of loading for the sea voyage (e.g. Felixstowe berth 8); or it could be the seller’s premises. So it is good practice for the buyer and seller to identify the place of delivery as well as the place of destination, and to include it in the commercial agreement.

If a place of delivery has not been agreed, and there is more than one carrier, then by default it is taken to be the point where the goods are taken in charge by the first carrier.

The U.S. Perspective

The Incoterms 2010 revision is of particular interest to companies in the United States for the following reasons.

Incoterms vs the Uniform Commercial Code

Trade practitioners in the U.S. will be aware that the terms FOB, CIF and so on are defined within the United States Federal Uniform Commercial Code (UCC). First published in 1952, UCC covers many aspects of commercial contracts. It contains “shipment and delivery” provisions that have similar aims to those of the Incoterms rules.

Some UCC expressions have the same three-letter abbreviations as those within the Incoterms system; but their definitions are totally different. Notoriously, “FOB” can have a number of different meanings within UCC, most of which do not correspond with the ICC Incoterms FOB definition.

Companies in the US are therefore faced with the prospect of mastering both the UCC for use with domestic transactions, plus ICC Incoterms rules for use with cross-border transactions.

Let’s format as presented by Onship Logistics; utilizing the following notes in the ‘More Details’ section:

Ex Works (EXW)

This rule places minimum responsibility on the seller, who merely has to make the goods available, suitably packaged, at the specified place, usually the seller’s factory or depot.

The buyer is responsible for loading the goods onto a vehicle (even though the seller may be better placed to do this); for all export procedures; for onward transport and for all costs arising after collection of the goods.

In many cross-border transactions, this rule can present practical difficulties.

Free Carrier (FCA)

A very flexible rule that is suitable for all situations where the buyer arranges the main carriage

For example:

- Seller arranges pre-carriage from seller’s depot to the named place, which can be a terminal or transport hub, forwarder’s warehouse etc. Delivery and transfer of risk takes place when the truck or other vehicle arrives at this place, ready for unloading – in other words, the carrier is responsible for unloading the goods. (If there is more than one carrier, then risk transfers on delivery to the first carrier.)

- Where the named place is the seller’s premises, then the seller is responsible for loading the goods onto the truck etc. This is an important difference from Ex Works EXW

In all cases, the seller is responsible for export clearance; the buyer assumes all risks and costs after the goods have been delivered at the named place.

FCA is the rule of choice for containerised goods where the buyer arranges for the main carriage.

Carriage Paid To (CPT)

The seller is responsible for arranging carriage to the named place, but not for insuring the goods to the named place. However delivery of the goods takes place, and risk transfers from seller to buyer, at the point where the goods are taken in charge by a carrier – see delivery.

Things to watch for:

- Terminal Handling Charges (THC) are charges made by the terminal operator. These charges may or may not be included by the carrier in their freight rates – the buyer should enquire whether the CPT price includes THC, so as to avoid surprises.

- The buyer may wish to arrange insurance cover for the main carriage, starting from the point where the goods are taken in charge by the carrier – this will not be the place referred to in the Incoterms rule, but will be specified elsewhere within the commercial agreement.

Carriage and Insurance Paid To (CIP)

The seller is responsible for arranging carriage to the named place, and also for insuring the goods.

As with CPT, delivery of the goods takes place, and risk transfers from seller to buyer, at the point where the goods are taken in charge by a carrier – see delivery.

Things to watch for:

- Terminal Handling Charges (THC) are charges made by the terminal operator. These charges may or may not be included by the carrier in their freight rates – the buyer should enquire whether the CPT price includes THC, so as to avoid surprises.

- Although the seller is obliged to arrange for insurance for the journey, the rule only requires a minimum level of cover, which may be commercially unrealistic. Therefore the level of cover may need to be addressed elsewhere in the commercial agreement

Delivered at Terminal (DAT)

The seller is responsible for arranging carriage and for delivering the goods, unloaded from the arriving conveyance, at the named place.

Risk transfers from seller to buyer when the goods have been unloaded.

‘Terminal’ can be any place – a quay, container yard, warehouse or transport hub.

The buyer is responsible for import clearance and any applicable local taxes or import duties.

Things to watch for:

- The place for delivery should be specified as precisely as possible, as many ports and transport hubs are very large.

A useful rule; well suited to container operations where the seller bears responsibility for the main carriage.

Delivered at Place (DAP)

The seller is responsible for arranging carriage and for delivering the goods, ready for unloading from the arriving conveyance, at the named place. (An important difference from Delivered At Terminal DAT, where the seller is responsible for unloading.)

Risk transfers from seller to buyer when the goods are available for unloading; so unloading is at the buyer’s risk.

The buyer is responsible for import clearance and any applicable local taxes or import duties.

Delivered Duty Paid (DDP)

The seller is responsible for arranging carriage and delivering the goods at the named place, cleared for import and all applicable taxes and duties paid (e.g. VAT, GST).

Risk transfers from seller to buyer when the goods are made available to the buyer, ready for unloading from the arriving conveyance.

This rule places the maximum obligation on the seller, and is the only rule that requires the seller to take responsibility for import clearance and payment of taxes and/or import duty.

Free Alongside Ship (FAS)

In practice it should be used for situations where the seller has direct access to the vessel for loading, e.g. bulk cargos or non-containerised goods.

For containerised goods, consider “Free Carrier FCA” instead.

Seller delivers goods, cleared for export, alongside the vessel at a named port, at which point risk transfers to the buyer.

The buyer is responsible for loading the goods and all costs thereafter.

Free On Board (FOB)

In practice it should be used for situations where the seller has direct access to the vessel for loading, e.g. bulk cargos or non-containerised goods.

For containerised goods, consider “Free Carrier FCA” instead.

Seller delivers goods, cleared for export, loaded on board the vessel at the named port.

Once the goods have been loaded on board, risk transfers to the buyer, who bears all costs thereafter.

Cost and Freight (CFR)

In practice it should be used for situations where the seller has direct access to the vessel for loading, e.g. bulk cargos or non-containerised goods.

For containerised goods, consider ‘Carriage Paid To CPT’ instead.

Seller arranges and pays for transport to named port. Seller delivers goods, cleared for export, loaded on board the vessel.

However risk transfers from seller to buyer once the goods have been loaded on board, i.e. before the main carriage takes place.

Seller is not responsible for insuring the goods for the main carriage.

Cost Insurance and Freight (CIF)

In practice it should be used for situations where the seller has direct access to the vessel for loading, e.g. bulk cargos or non-containerised goods.

For containerised goods, consider ‘Carriage and Insurance Paid CIP’ instead.

Seller arranges and pays for transport to named port. Seller delivers goods, cleared for export, loaded on board the vessel.

However risk transfers from seller to buyer once the goods have been loaded on board, i.e. before the main carriage takes place.

Seller also arranges and pays for insurance for the goods for carriage to the named port.

However as with “Carriage and Insurance Paid To”, the rule only require a minimum level of cover, which may be commercially unrealistic. Therefore the level of cover may need to be addressed elsewhere in the commercial agreement.